flow through entity canada

Types of flow-through entities. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income.

Report To Parliament On The Government Of Canada S International Assistance 2018 2019

In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

. A business owned and operated by a single individual. If you make a withholdable payment to a flow-through entity that is not one of the types described above you must treat the partner beneficiary or owner as applicable of the flow-through. For Canadian income tax purposes ULCs are considered corporations and are subject to Canadian income taxation.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. A flow-through limited partnership is an equity investment in a portfolio of flow-through shares of Canadian resource companies that. However for US tax purposes ULCs may be treated either as.

Shares issued directly by a resource company and flow-through LP units. Is S corp a pass-through entity. However for US tax purposes ULCs may be considered.

S corps are pass-through taxation entities. Flow-through shares are a financing tool available to a Canadian resource company that allows it to issue new equity shares to investors at a higher price than it would receive for normal. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain.

A trust maintained primarily for the benefit of. What is a flow-through limited partnership. There are two types of flow-through investments.

They file an informational federal return Form 1120S but no income tax is paid at the corporate. Downsides to Flow-Through Entities. Flow Through Entities Owned by Residents of Canada.

There are three main types of flow-through entities. Issued by entities that purchase a. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow.

Limited Liability Partnership Llp Partnership Structure Kalfa Law

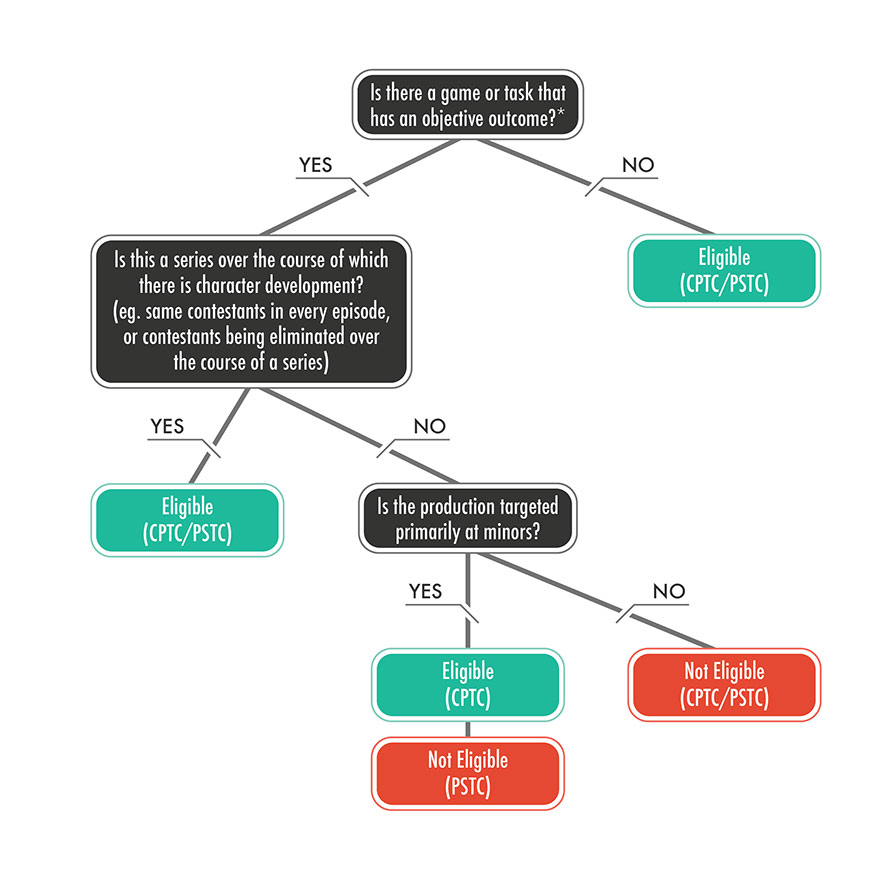

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

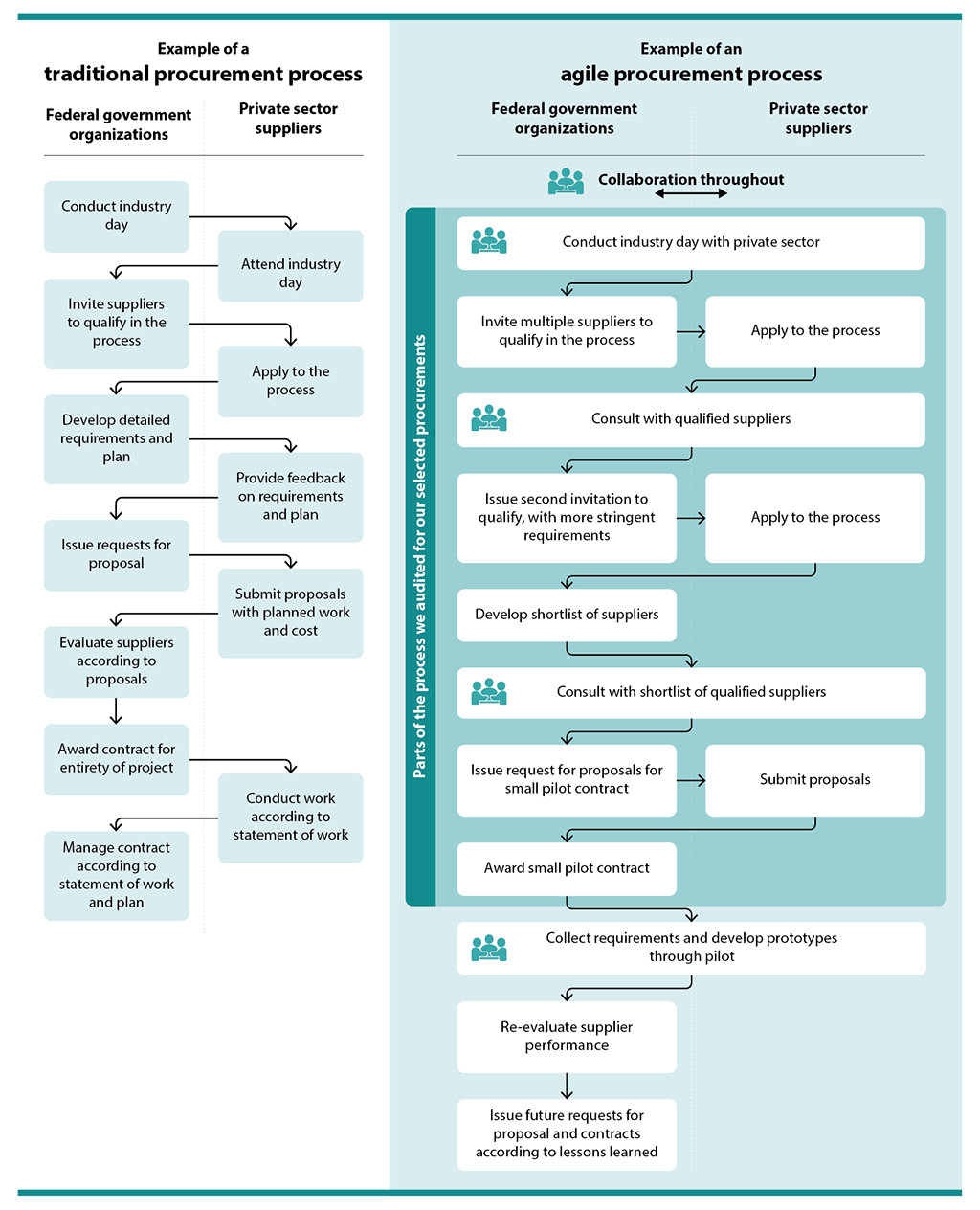

Report 1 Procuring Complex Information Technology Solutions

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

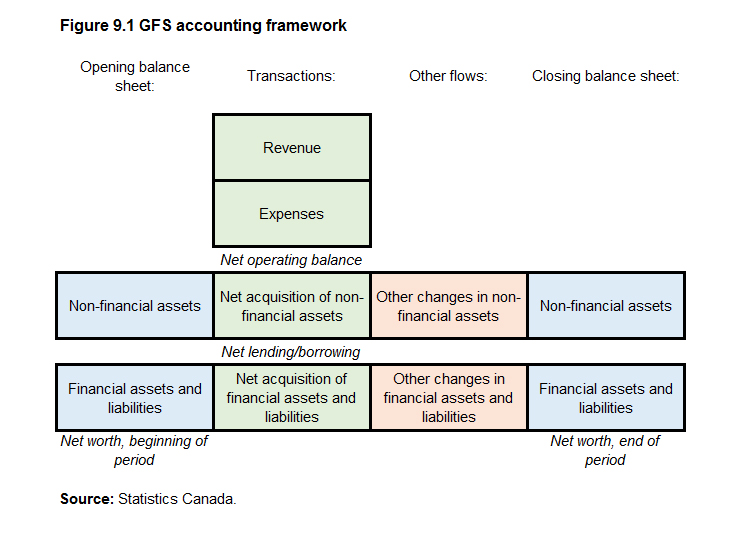

Chapter 9 Government Finance Statistics

Chapter 9 Government Finance Statistics

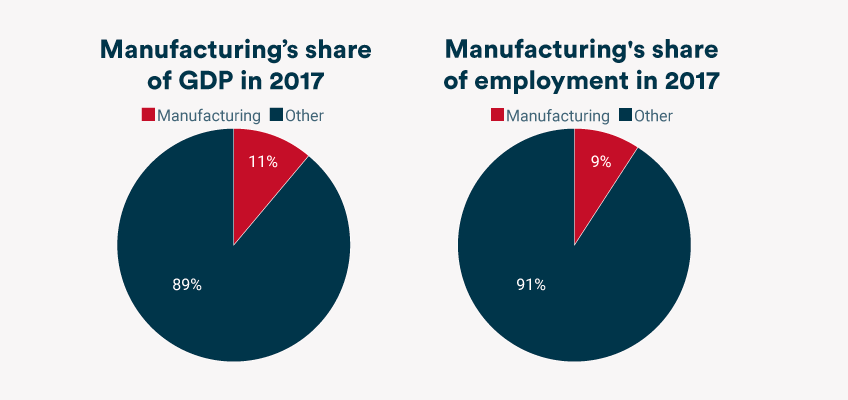

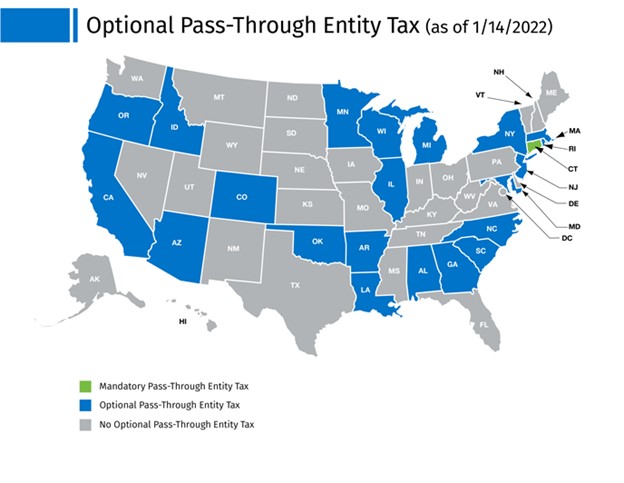

An Overview Of Pass Through Businesses In The United States Tax Foundation

Elective Pass Through Entity Tax Wolters Kluwer

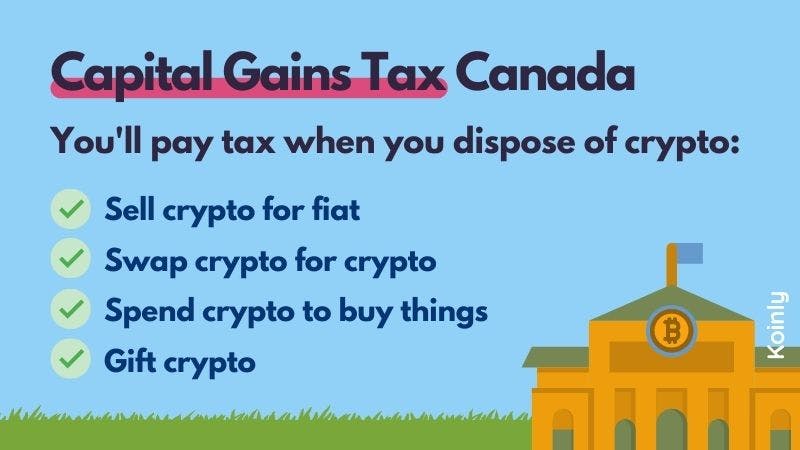

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Pass Through Entity Definition And Types To Know Quickbooks

Report To Parliament On The Government Of Canada S International Assistance 2018 2019

Chapter 3 Key Concepts In Brief

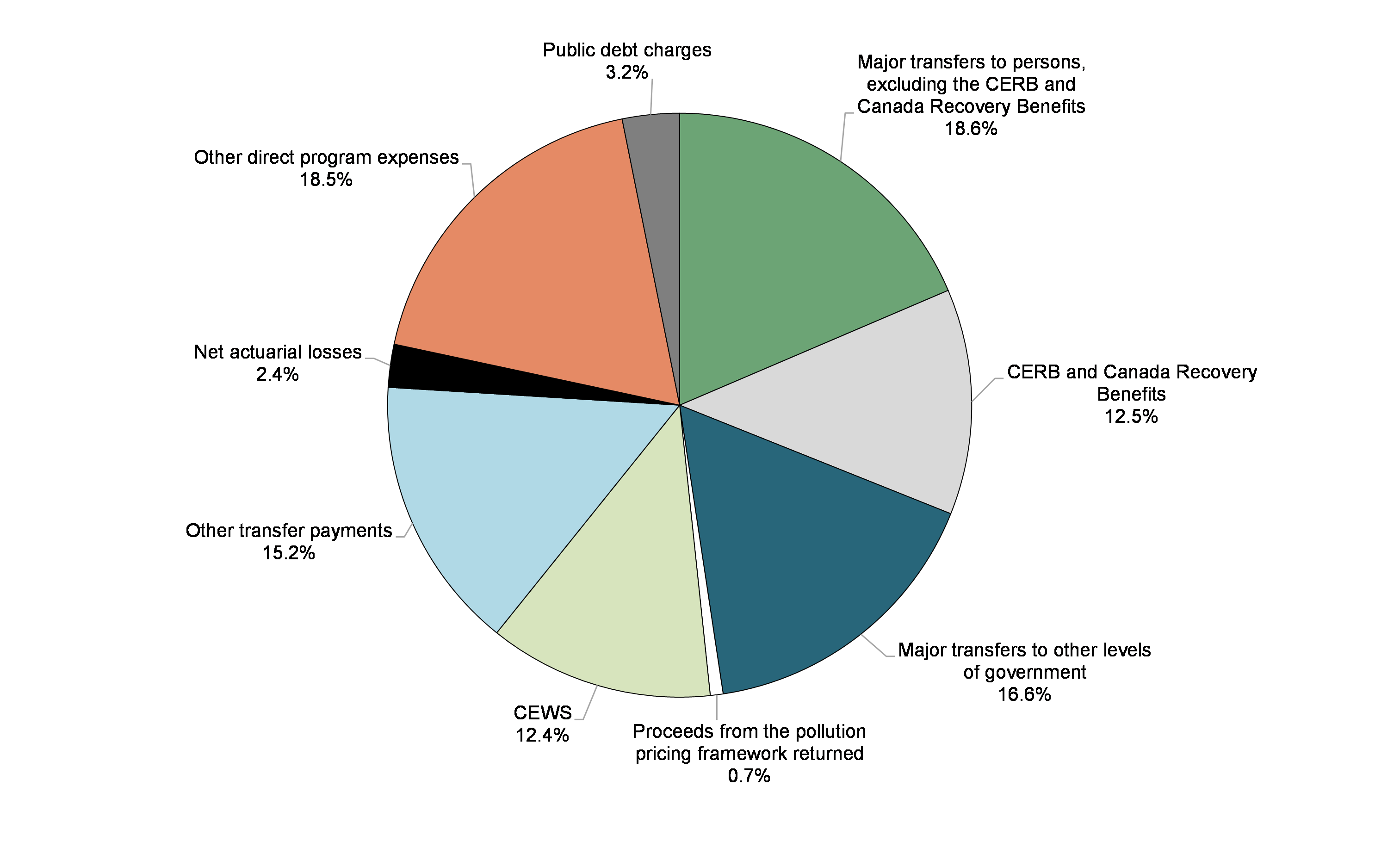

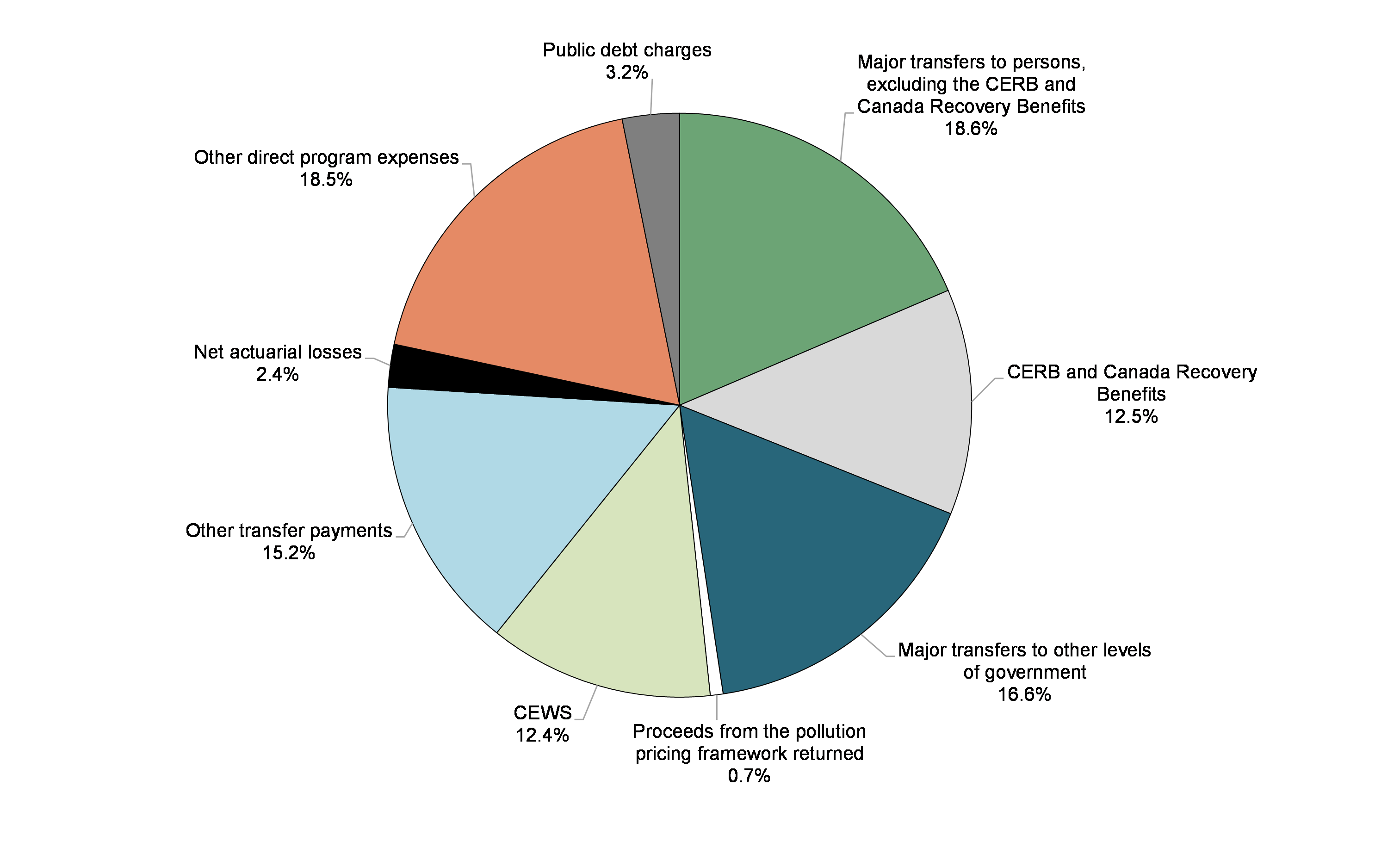

Annual Financial Report Of The Government Of Canada Fiscal Year 2020 2021 Canada Ca

Pass Through Entity Definition And Types To Know Quickbooks